April 1, 2021

UK Real Estate: The Opportunity in 2021

FOREWORD by Alex Price, CEO – Fiera Real Estate UK March 2021

On the anniversary of the first UK COVID-19 lockdown, we are reminded of Karl Marx’s quote that “there are decades where nothing happens; and there are weeks where decades happen.”

2020 saw an explosion in governmental deficits, a move to negative interest rates in much of Europe and the mass adoption of new workplace and retailing habits; shifts that are here to stay.

The human and economic scars of COVID-19 have been deep, with a global pandemic amplified in the UK by the coincidence of the departure from the European Union. This has created significant change in the long-term trading and diplomatic arrangements at a time when political focus is, necessarily, diverted to the present – saving lives and jobs. The convergence of these twin challenges may partly explain why the UK GDP fell by nearly 10% in 2020.

However, in 2021 the UK has settled its political relationship with Europe and aggressively rolled out a vaccination programme. Given the discounted values of UK assets against its continental European peers, and the strong forecast GDP recovery and the recent weakness of Sterling against the US Dollar, we believe that we will look back at this time as a generational buying opportunity.

The UK has one of the fastest growing European populations, an open and developed economy, deep adoption of online retailing and the ability post-EU to support a sustained and broad recovery. This means that the creation of new assets to meet new political and working practices and the repurposing of obsolete assets, marooned by a combination of Brexit and COVID-19, will happen relatively quickly. Change will also be driven by the ending of 2020’s universal debt forbearance with the massive increase in provisioning by UK banks in 2020, giving them the ability to enforce sales in non performing loans.

In the coming months and years, we expect to see UK assets appreciate in value, albeit from a low base, with strong demand to create and adapt assets for the future. On top of this, Sterling should continue to appreciate, providing a welcome additional boost to overseas investors. If ever there was a time to look again at investing into UK real estate, this may well be it.

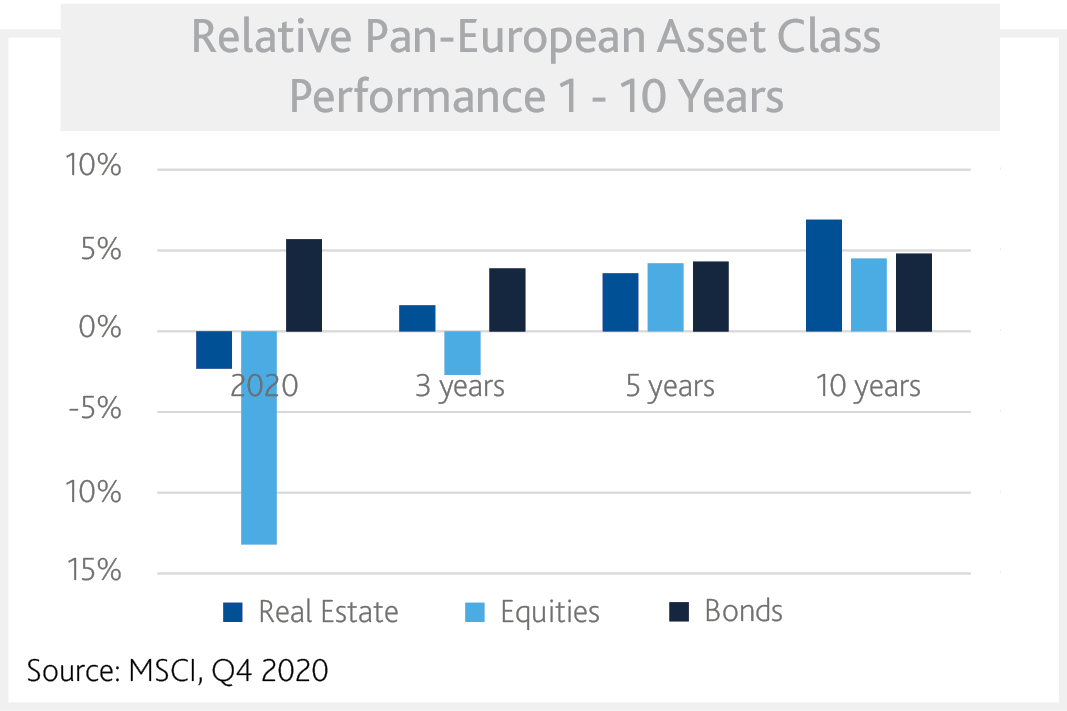

1. Consistent Absolute Returns

Over the last 10 years pan-European real estate returned around 8% pa in contrast to the volatility of other asset classes.

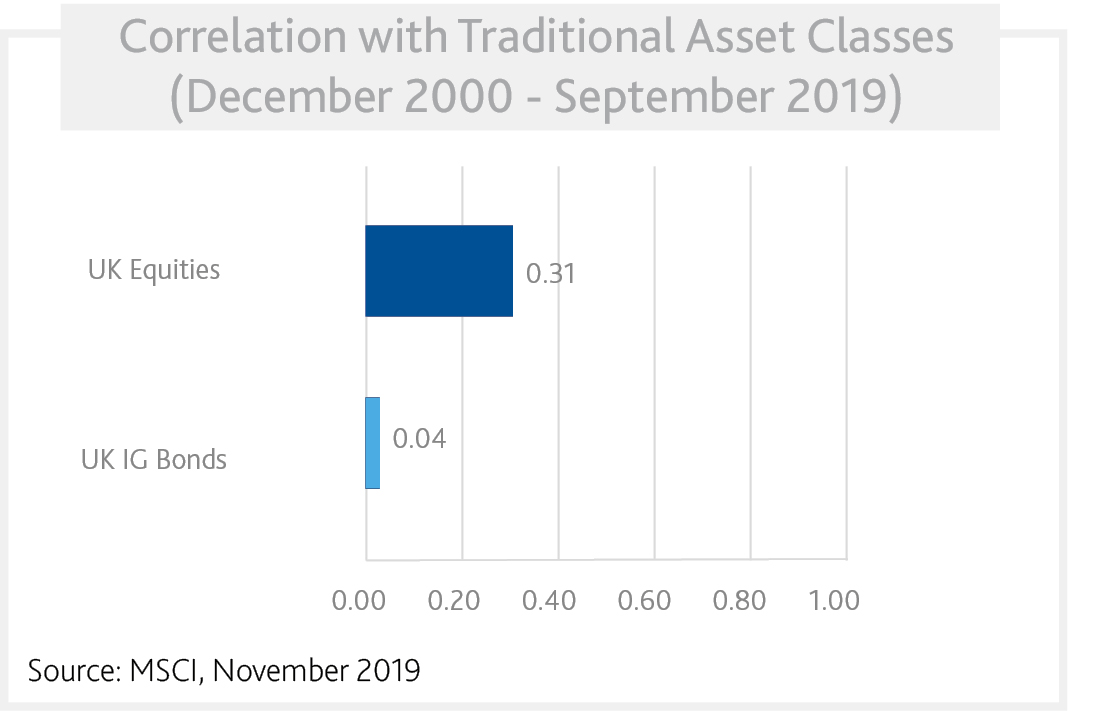

2. Benefits of Diversification

Real estate has low correlation with bonds (0.04) and equities (0.31) providing attractive diversification benefits within a multi-asset portfolio.

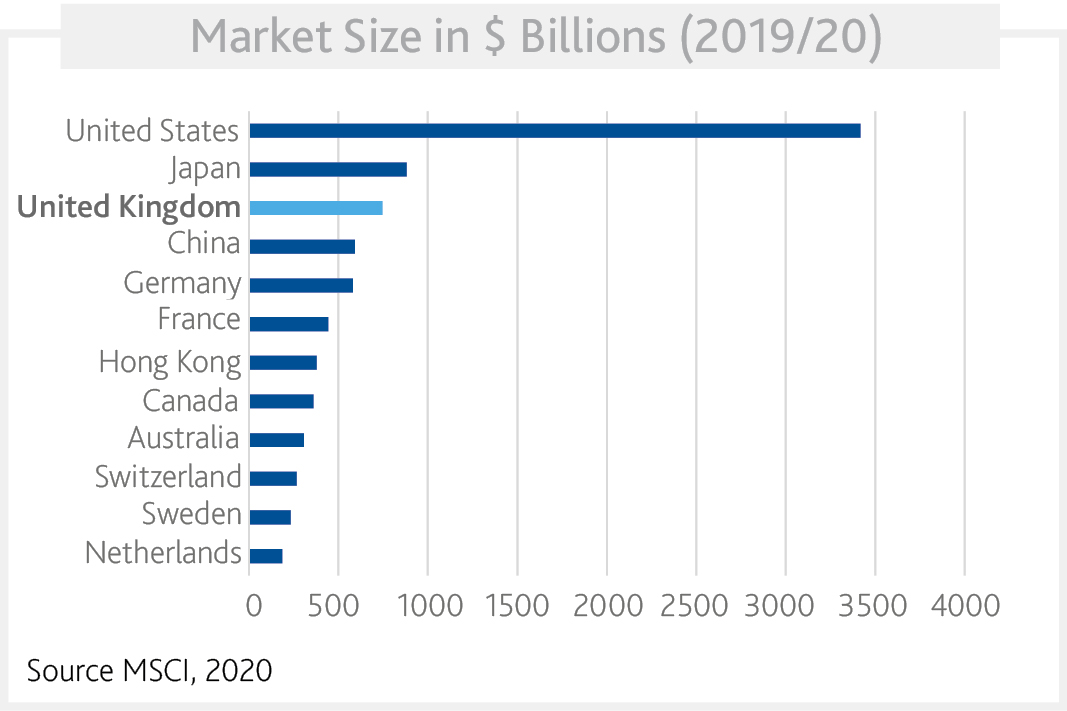

3. Deep and Liquid Real Asset Market

Commercial real estate is a huge market globally. MSCI estimate that the professionally managed global real estate investment market has a value of $9.6trn. The UK is the largest real estate market in Europe and the third largest commercial real estate market in the world, with $700bn of professionally managed real estate assets, as shown below.

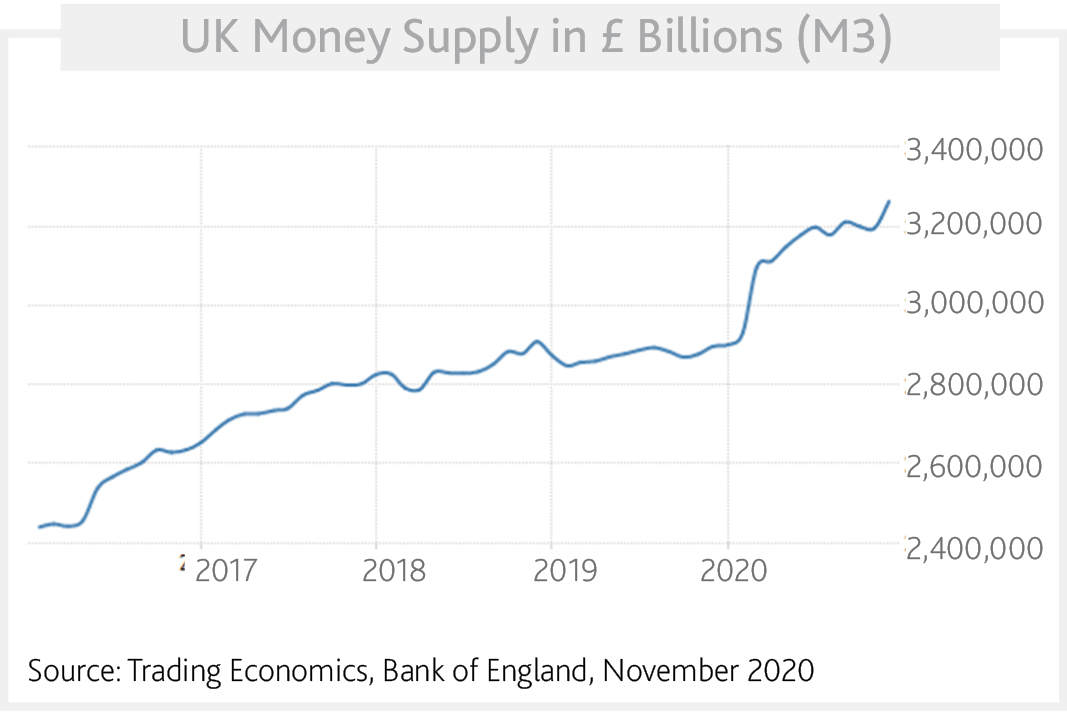

4. Protection Against Inflation

Money supply increased by over 10% in 2020 as global liquidity was injected. This shift in the Federal Reserve’s inflation polices led UK forecaster, Capital Economics, to write in February 2021 that a jump in the Consumer Price Index measure of inflation “to around +2.0% in April and to around +2.5% by the end of the year appear to be baked in the cake”.

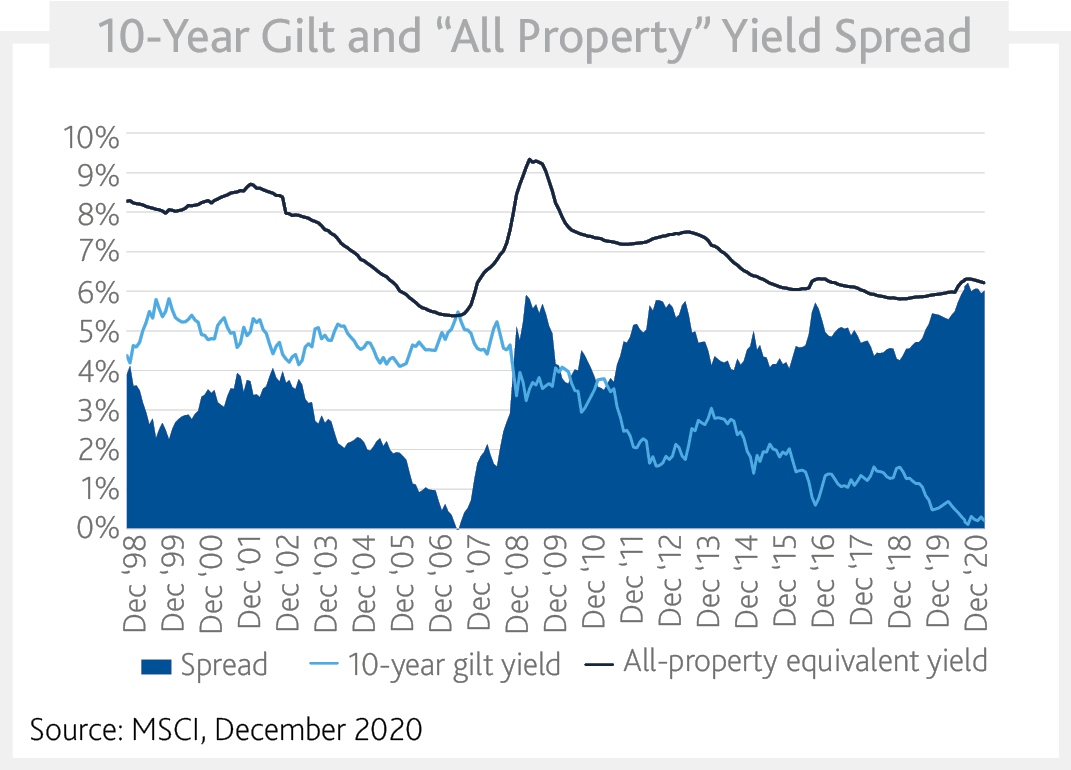

5. Relative Yield to Fixed Income

With interest rates likely to remain very low for the medium term, real estate will remain attractive as a way to deliver stable and higher yielding cash flow. The gap between real estate yields in the UK and UK base rates is around 6%.

Why UK Now?

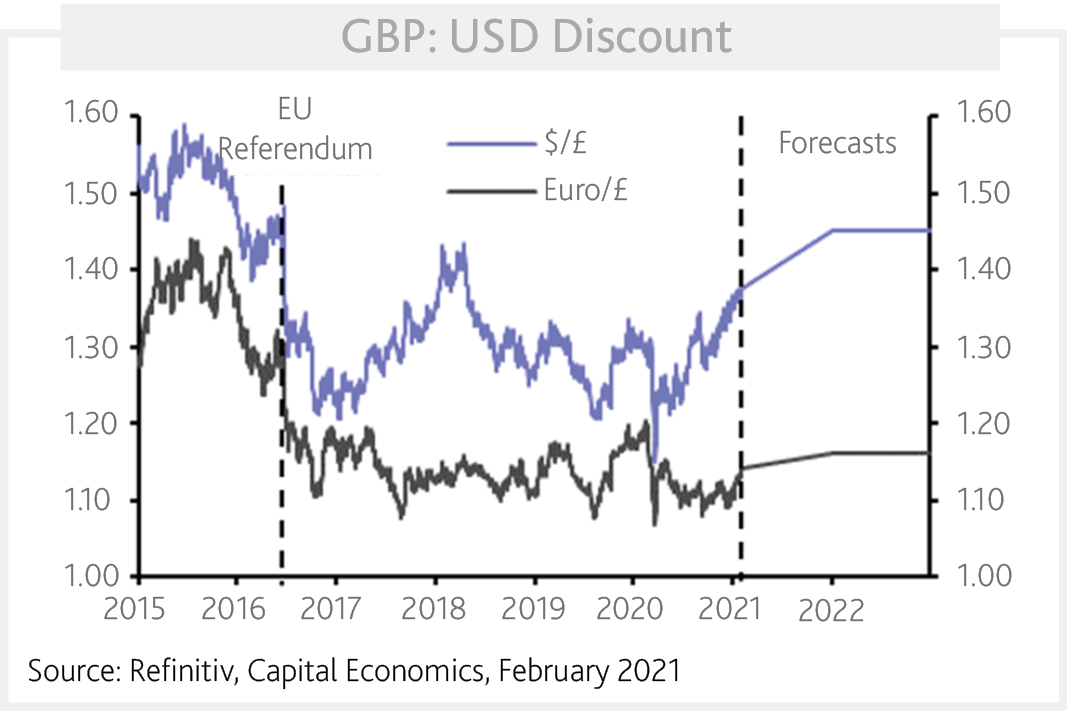

1. GBP:USD Exchange Rate

Post the UK vote to exit the EU in 2016, Sterling weakened by around 15%. Whilst this has closed in recent months, a discount remains for foreign investors, which many people have forecast to reduce even further as the disruption of COVID-19 and Brexit passes.

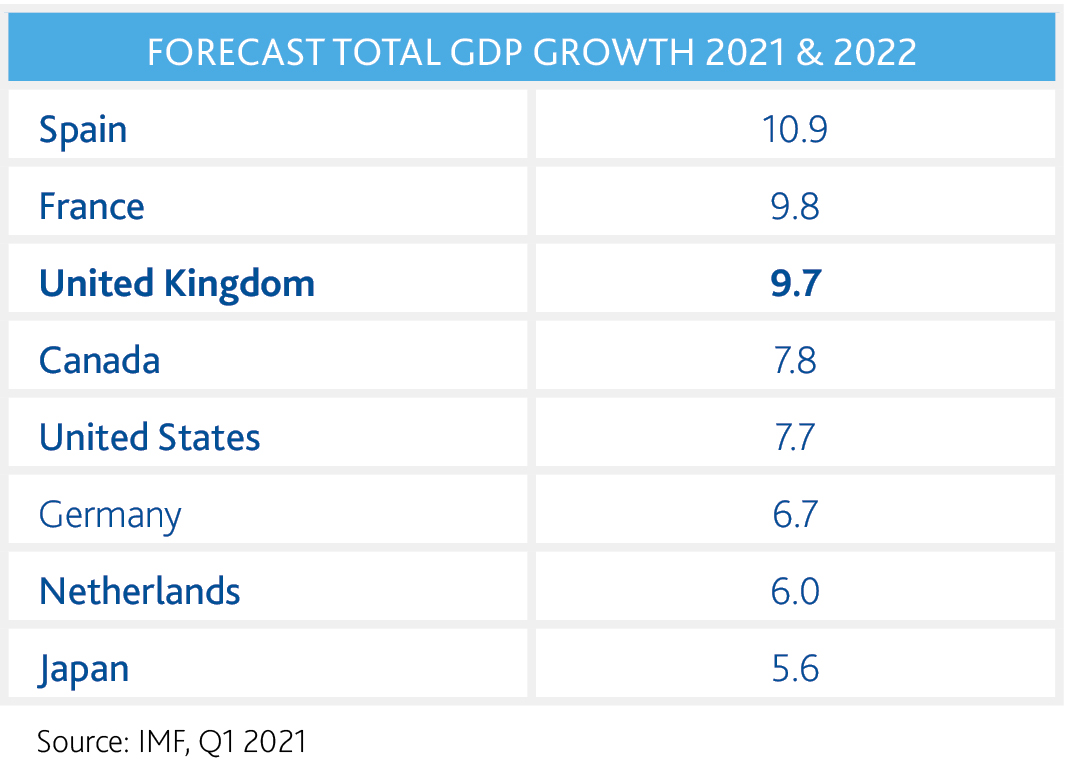

2. UK Forecast GDP Recovery

With the UK vaccine programme advanced and over a third of the population vaccinated by late February 2021, the UK is closer than many countries to post-COVID-19 normalisation. Given this, the UK is forecast to see the third highest GDP recovery of the major developed economies in 2021 and 2022, giving the impetus to support occupational demand and rental values.

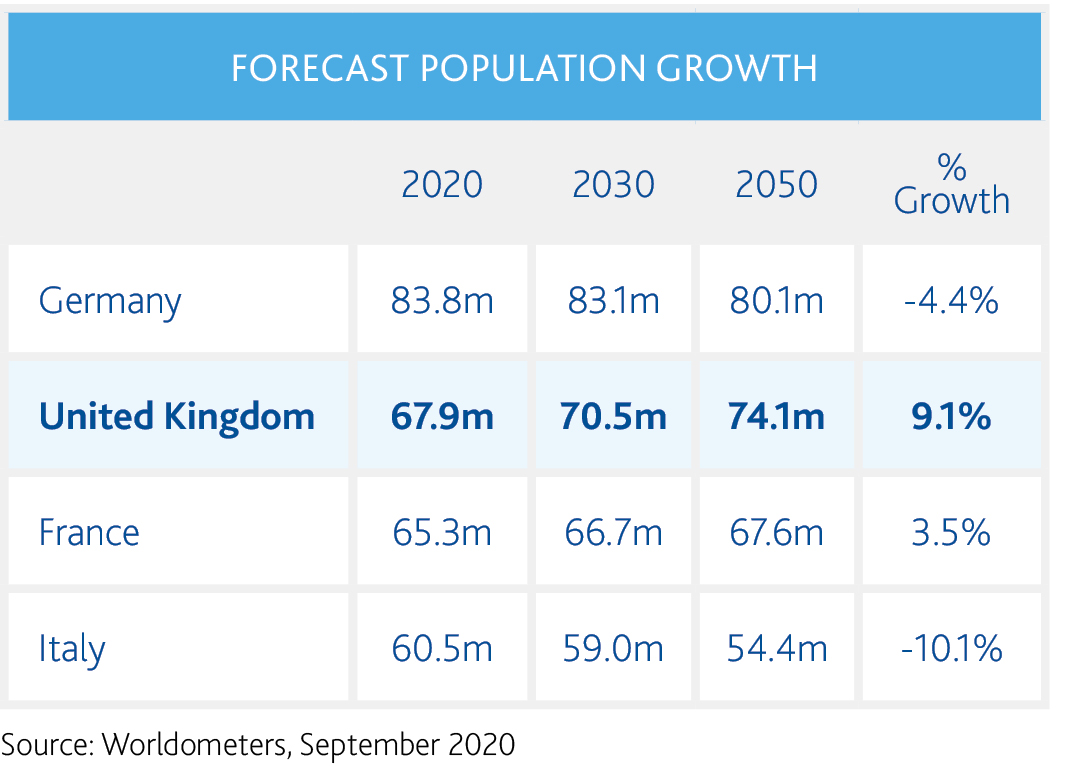

3. Demand from Population Growth

Population growth underpins robust demand in the UK, which is forecast to have c. 9% population growth over the next three decades, as shown in the table below. It is compounded by the fact that the UK has the third highest population density of the major countries in Europe.

4. Accelerated Change

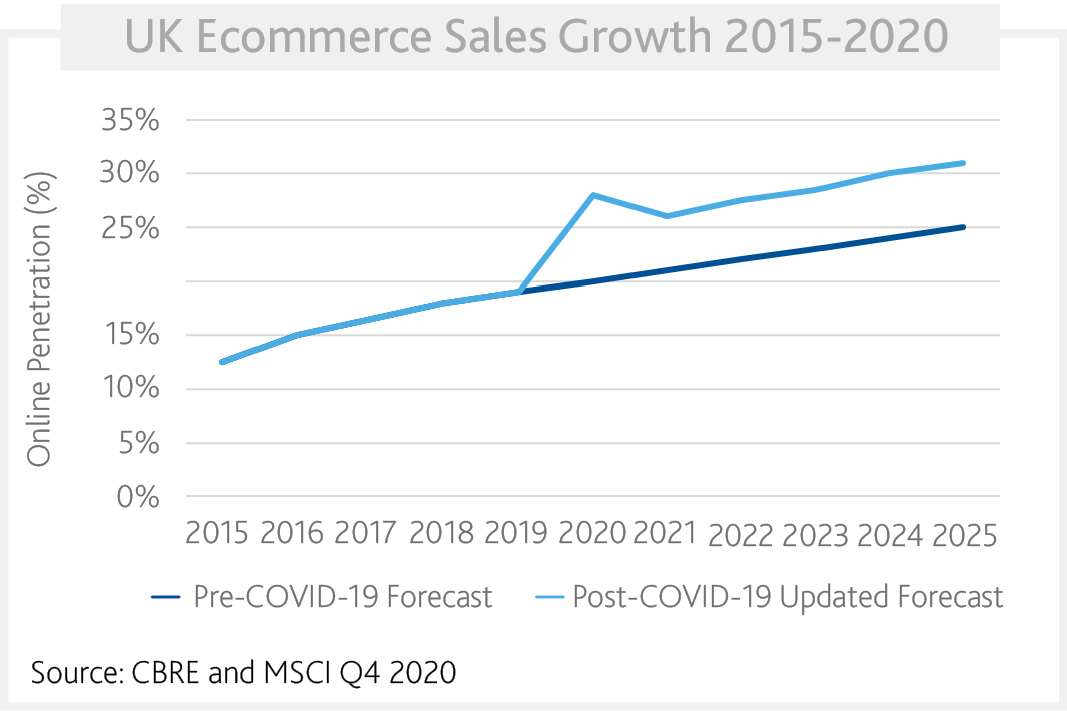

Departure from the EU has led to a requirement for new supply chains to be built, exacerbated by the dramatic shift in online sales caused by COVID-19. In the UK, the predicted five-year estimate for online sale penetration was achieved in Q2 2020.

5. Relative Value from Brexit

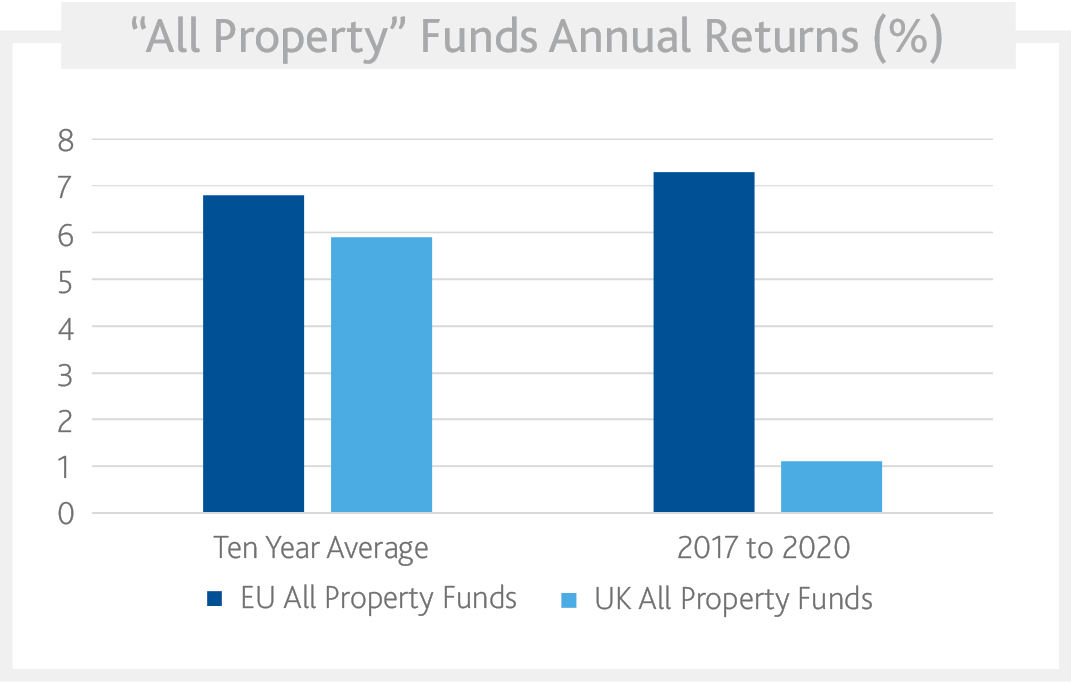

We believe the UK is the most undervalued market in Europe. Since the UK started to exit the EU, the gap between annual performance in EU v UK funds has grown from 90 bps to 620 bps.

Considerations to Make Use of the UK Opportunity

Create Grade “A” Income

Maturing UK pension funds need to find yield and to liability match, driving demand and the opportunity to create, and then own, high quality income.

Focus on Under-Supplied Residential and Logistics Markets

An imbalance in supply and demand exists across the UK in warehousing (post-Brexit and with the explosion of online sales) and in residential (both for sale or rent and affordable or private). This will create a price acceleration until a balance can be restored.

Transition Urban Assets

Rapid change has marooned now functionally obsolete assets, such as in-town retail, and repositioning opportunities in major UK cities to meet the demand of a growing population will increase in denser, higher value areas.

Re-Imagine Offices

Corporate real estate customers office requirements are changing, and to retain them, landlords will need a more flexible and highly engaged approach to compliment the increase in demand for better quality, modern, efficient, and well-located office hubs for creativity and collaboration.

“It’s the environment, stupid” (to misquote the Clinton administration)

Every business has a corporate responsibility, but real estate owners have an additional responsibility to ensure the built environment is both ready for the inevitable environmental changes, and to reduce the effects of that change. Failure to do so will render assets incapable of repurposing, accelerate obsolescence and deter occupational interest.