September 28, 2021

Originally published by Investment Week in September 2021.

Written by Alex Price, CEO, UK.

- Increased demand for Real Estate due to inflation hedge and 4%+ yield premium

- Increased demand in UK due to population and e-commerce growth

Income-seeking investors, especially defined benefit pension schemes, face the dilemma of how to meet growing liabilities from sustained low returns from traditional lower risk assets. This isn’t new, with fixed income returns depreciating in recent years, five-year rates on UK Gilts are currently 0.3%. What is new is the return of inflation, forecast to rise to 4% per annum in 2021, according to the Bank of England August 2021 monetary report.

In past decades, rising inflation would be offset by rising interest rates, but this seems unlikely with the economic recovery still fragile. More importantly, low interest rates are key to the UK Government’s ability to service its debt, which is largely bought by the Bank of England, which has no incentive to drive up the required return on these bonds. In the years ahead, not only will investors earn little from low-risk assets like fixed income or cash, which is often insufficient to meet the promised liabilities, in real terms, they will be heading backwards.

How should UK investors react to the problem, given it is not going away? Can they afford to wait for fixed income returns to rise, should investors take more risk to meet returns, will the liabilities reduce? The answer is almost certainly no to all of these. Investors need to find alternative sources of income and to act sooner rather than later. To quote Winston Churchill, “never worry about action, but only inaction”.

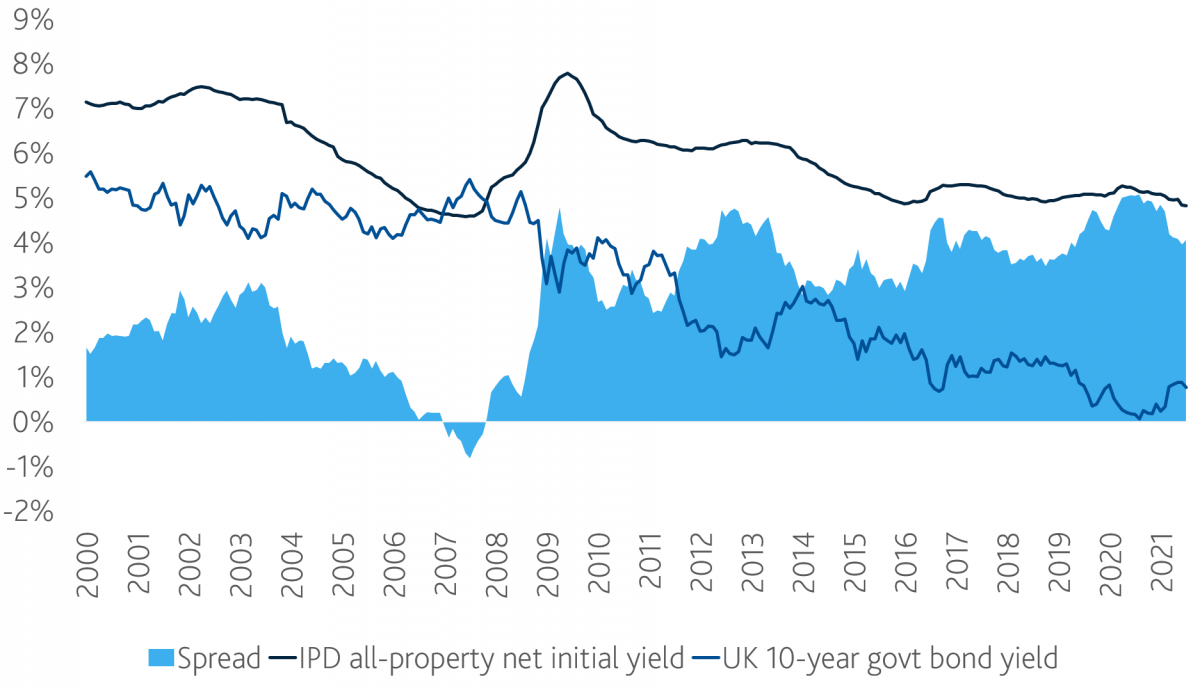

In our opinion creating and owning stabilised “Grade A” Real Estate assets can deliver sustainable, risk-adjusted, income-based returns. Today, property net initial yields stand at 4.5% (source MSCI), although yields on the best assets trade at lower yields. This level of return from Real Estate means income from the start will exceed not only other secured income alternatives but will deliver a positive real return. Real Estate can also help provide a hedge against ongoing inflation in the longer term, with the strongest historic correlation in sectors such as residential, offices and industrial assets.

All property equivalent yield vs Gilts vs Base Rate

Source: JLL, September 2021

Real Estate does have one crucial difference relative to bonds; at the end of the lease, the rent ceases and, unless the lease is renewed, the building is returned to the investor. Whilst it is normally returned “fully repaired” i.e. the same state it was at the lease commencement, owners may face capital expenditure and a period without rental income whilst they re-lease the property.

In the UK, Fiera Real Estate has focused on residential and logistics assets, where strong demand reduces leasing risk. Risk is also mitigated through buying modern “Grade A” buildings which will have less obsolescence, buying buildings in locations with strong alternative use, or buying buildings with longer leases where, on a net present discounted basis, this re-leasing cost is reduced as a proportion of the overall cash flow.

Many long-term investors have already increased their allocations to Real Estate and, as demand increased in the last few years, it has not been easy securing these assets. The demand for lower risk income will not go away in the near future, so thoughtful investors need to find experienced partners to help them access the market, either through buying standing assets or creating the assets themselves.

Investors need to focus on finding alternative sources of income-based returns, and the longer they wait, the larger the funding gap grows. With a UK Real Estate market of over £8trn (source Savills, ONS, Land Registry, MHCLG and UK Finance), four times the size of the FTSE 100, this is a market solution that we ignore at our peril.