May 24, 2018

I was at a drinks party before Christmas where the mood in the room was mixed about the prospects for UK real estate for the year ahead. An industry friend of mine and investor told me that he wouldn’t be investing in 2018 as we were too deep into the current cycle and he couldn’t see where the capital growth would be coming from. I told him he was missing the point; capital growth should be the by-product of sound long term income investing and not the goal in itself.

The underlying commercial occupier markets are currently undergoing a period of unprecedented structural change. For those investing in the right areas, with a longer term outlook, there remains a compelling case for staying active.

Enduring Appeal

With an income yield of 5.0% per annum on the MSCI/IPD annual index (December 2017), UK commercial real estate continues to do what it says on the tin out stripping other principle asset classes when it comes to delivering a dependable income return. This is key during periods of lower economic growth.

Over the 38 years that MSCI/IPD have been measuring commercial real estate returns, income has represented over 80% of the total return. For those patient enough to ride out the cycles this is a key and a very appealing differentiator.

Market Fundamentals

We are approximately eight years into the current market cycle. History tells us that we are overdue a correction. However, global government intervention across major markets and economies distorts the picture and real estate has always been a good hedge against inflation. Whilst inextricably linked to other asset classes and capital markets, there are various measures which could lead one to conclude that UK core unlevered real estate is less at risk of a correction than either the bond or equity markets which currently trade at historic highs.

A Two Speed Market: Revolution or Evolution?

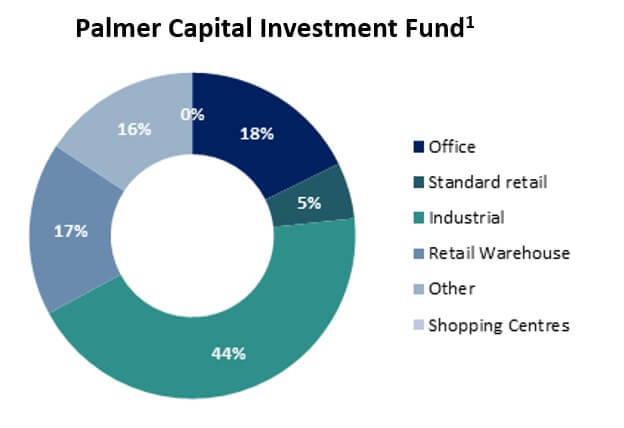

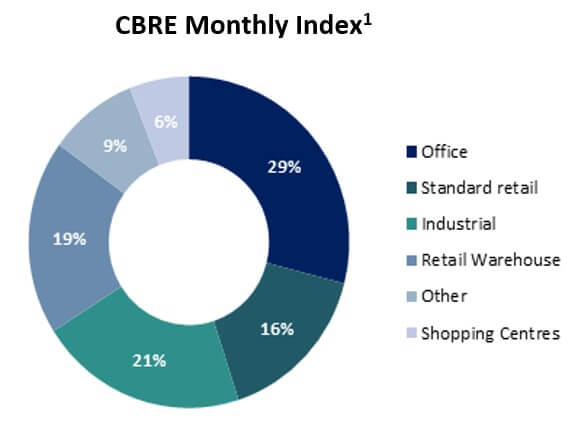

41% of the measured UK commercial real estate market is invested in the retail sector (see graphs below) representing either high street shops, shopping centres or out of town retail. The underlying retail sector is in the grip of a once in a generation revolution driven by the internet. This is making huge swathes of retail real estate obsolete and irrelevant with limited scope for re-purposing to defend against further rental and capital value falls. This is particularly the case with shopping centres and unit shops where similar value alternative uses simply don’t exist. The future is extremely bleak for investors overweight in these types of assets and is one of the reasons why our core Palmer Capital Investment Fund only has a 5% allocation to non-out-of-town retail.

However, on the opposite side of the retail coin is a sector with an altogether sunnier disposition. The burgeoning industrial sector has been the principle beneficiary of this retail malaise with internet retailing driving strong occupier demand in both urban logistics locations and those areas well served by the motorway network. Amazon alone were responsible for the largest take up of industrial and logistics space in 2016 and this internet theme continues to drive both rental and capital growth. Macro pressures are whipping up what appear to be perfect conditions for those already invested in the sector.

Supply side pressures are also building in a positive way for industrial investors with cross party support in Parliament for the need to build more homes for the UK’s growing population. This pressure is particularly acute in the major cities as the population trends towards urbanisation creating industrial land supply issues as a number of “brown field” industrial sites are being lost to residential for ever. This is good news for industrial investors and the demand/supply imbalance is not only helping drive rental and capital growth but is also leading to strong residual alternative use values for the underlying land.

This compelling dynamic is informing our current investment strategy leading to a large overweight position in the industrial sector in our core Palmer Capital Income Fund. We are also pursuing bespoke strategies for land value enhancement through the planning process for our opportunistic mandates where capital appreciation via re-purposing of sites is the principle objective.

Industrial Investing – It doesn’t have to be pretty…

And What About Technology?

The real estate industry thrives on imperfect knowledge which in turn creates miss pricing and opportunities. It has been slow to adapt to technological change.

Palmer Capital has stolen a march in this area with a sharp focus on how best to incorporate modern technology into building design and development so as to ensure that the built environment adapts to the requirements of modern day occupiers. This involves working with would be tenants as customers to ensure the delivery of floor space that matches their evolving needs. This can be seen with our current construction of a c.100, 000 sq. ft. grade A office building in central Bristol where the procurement process involves the delivery of a “smart” building with automated and zonal climate control together with a drone landing pad on the roof! Occupier needs are evolving rapidly: it is incumbent on landlords and developers to respond to these in order to gain commercial advantage.

There is a lot of change going on across the UK commercial real estate market – much of it unprecedented. This will create opportunities as well as risks and as always there will be winners and losers. As for my friend who is sitting out the market in 2018, I can’t help but think he is missing out. At a time of rapid change it generally pays to be sitting at the front of the bus rather than tagging along behind.

Author: Rupert Sheldon, Head of Income REIM at Palmer Capital